Planning a family trip often comes with various challenges, and managing currency exchange is a critical aspect that can either simplify or complicate the experience. Knowing the best ways to exchange currency before travel can save time, reduce fees, and protect against unfavorable rates. Understanding the options available can empower families to make informed decisions and enjoy their vacation without unnecessary financial stress.

Travelers can choose from several methods for currency exchange, including banks, airports, and online services. Each has its advantages and disadvantages, which can significantly affect the amount of money one has to spend at the destination. By evaluating every option carefully, families can find the solution that best meets their needs.

Successful currency exchange is about more than just getting the best rates; it’s also about convenience and accessibility. Planning ahead can lead to smoother transactions abroad, allowing families to focus on what truly matters: enjoying their time together and creating lasting memories.

Understanding the Basics of Currency Exchange

Currency exchange is a fundamental aspect of international travel. Being informed about exchange rates and available options can significantly simplify transactions while abroad.

Determining Exchange Rates

Exchange rates fluctuate based on various factors, including economic conditions, market demand, and geopolitical events. Travelers can check rates through several sources, such as:

- Banks: Often provide competitive rates but may charge fees.

- Online platforms: Websites and apps update rates in real-time.

- Currency converters: Handy tools for an on-the-go estimate.

It’s essential to compare these sources to determine the best rate. A small difference in rates can lead to substantial savings, especially for larger amounts. Note that the rates displayed may differ from those applied when exchanging money.

Currency Exchange Options

Travelers have several options for exchanging currency:

- Local Banks: These often offer reliable rates and secure transactions. However, they may have limited hours and occasionally charge a service fee.

- Currency Exchange Services: Found at airports and tourist areas, they provide immediate access to cash but typically at less favorable rates.

- ATMs: Using a debit card at an ATM can offer competitive rates. Travelers should check with their bank about withdrawal fees.

- Credit Cards: Many credit cards provide fair exchange rates without foreign transaction fees, enhancing convenience.

Each option has its advantages and potential drawbacks. Careful consideration of these factors ensures travelers can access currency with minimal effort and optimal value.

Planning Your Currency Needs Ahead of Time

Planning currency needs before a family trip can significantly enhance the travel experience. Factors like estimating the budget and knowing the optimal times for currency exchange can prevent unnecessary stress.

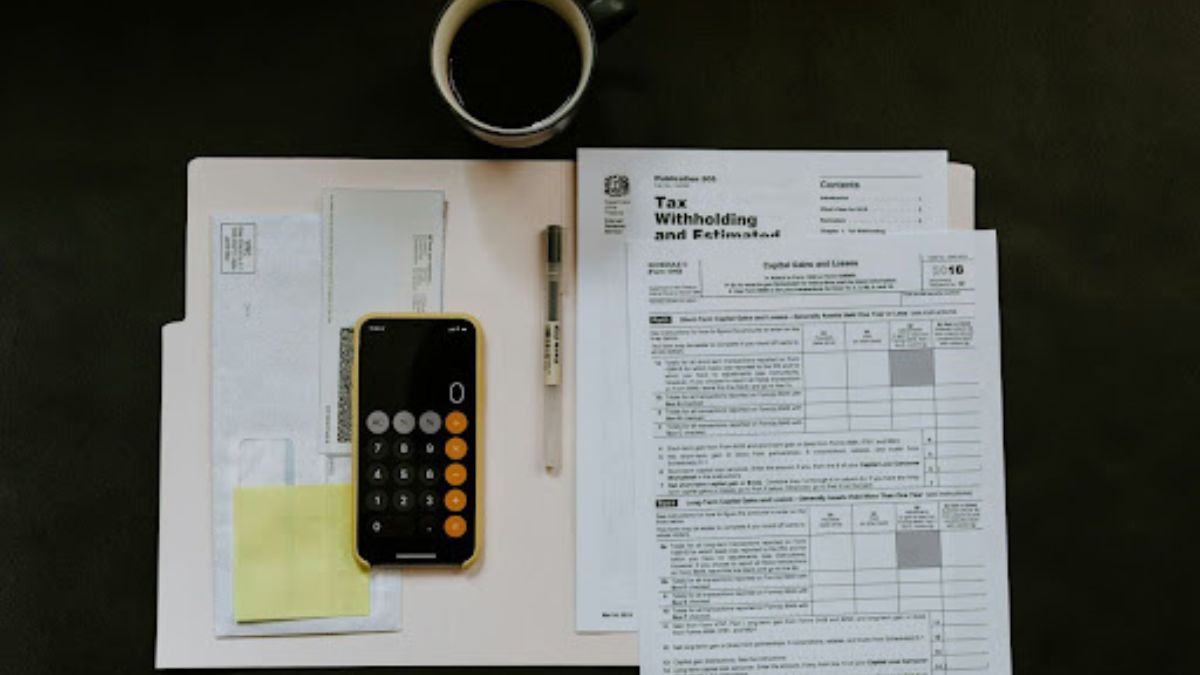

Estimating Your Travel Budget

Travelers should begin by determining their travel budget to understand how much currency they will need. This involves outlining expenses such as accommodations, food, transportation, activities, and souvenirs. It’s helpful to break down daily expenses for better clarity.

Creating a simple table can aid in this process:

| Expense Type | Estimated Amount |

| Accommodations | $X per night |

| Meals | $Y per day |

| Activities | $Z total |

| Transportation | $W total |

Adding a contingency fund of about 10-15% is advisable for unexpected costs. This preparation helps ensure adequate funds are available throughout the trip.

Finding the Best Times to Exchange Currency

Timing currency exchange can have a notable impact on the amount received. Knowing when to exchange can yield better rates and save money. It’s beneficial to monitor currency markets for fluctuations.

Travelers should consider local and international rates. Often, banks and exchange services offer competitive rates, while airport exchanges may charge higher fees.

Using online tools can facilitate finding better rates. Subscribing to alerts or using cost comparison websites enables travelers to seize favorable exchange options as they arise. Planning in advance reduces the risk of unfavorable rates impacting the budget during the trip.

Managing Currency Exchange While Travelling

Efficient currency management can significantly enhance the travel experience. Knowing how to use credit or debit cards abroad and avoiding common pitfalls can lead to smoother transactions and save money.

Using Credit and Debit Cards Abroad

Using credit and debit cards is a convenient way to handle currency exchange while traveling. Internationally accepted cards are widely accepted in many establishments, which makes transactions easier.

Before traveling, inquire with the bank about foreign transaction fees. Some banks offer cards with no foreign transaction fees, allowing travelers to save money. Additionally, she should notify her bank of her travel plans to avoid any disruptions.

When making purchases, select the local currency for better rates. Avoid dynamic currency conversion, as it often includes unfavorable exchange rates.

Always have a backup payment method, such as cash or another card, to avoid issues with card acceptance at some locations.

Avoiding Common Mistakes and Fees

Travelers often face unexpected fees when exchanging currency. Common mistakes include exchanging cash at airports or tourist hotspots, which typically offer poor rates.

Using an ATM for cash withdrawal can be an effective alternative, but it’s important to choose ATMs associated with reputable banks.

Before withdrawing, check for any ATM fees. Travelers should also be mindful of their daily withdrawal limits and inform their banks to ensure smooth access to funds.

Additionally, using prepaid travel cards can provide budget control. These cards allow individuals to load a specific amount of money in the local currency and minimize currency fluctuation risks.

By staying aware of these details, travelers can manage their currency exchange effectively and enjoy their trips without financial stress.

Whether you’re gearing up for a family vacation or a weekend getaway, one of the most important things to consider is currency exchange. The right exchange rates can save you money, especially for international family trips. Find a convenient currency exchange location in Brighton to ensure you’re prepared before you go.